Altruist Smart Express Dec 2023 issue

Editor’s Corner

Have you ever met a professional taxi driver who possesses good driving attitude and demeanor?

Or have you ever met a cleaning lady who works attentively, meticulously and always wear a smiling face?

Obviously, they have exemplified a dedicated work ethic and striven to be the best in their respective professional fields.

As what our President always says, among all industries, only the top 20% of practitioners are of respectable quality; conversely, the bottom 20% are unqualified and fall below standard quality while the middle 60% are mediocre individuals who merely seek for a stable job. Wanna be a part of the top 20%? Perhaps the sharing from the late basketball player Kobe Bryant can offer you an insight about his key to success: "It’s all about focus. Having a focus and purpose in mind, you will find yourself wake up every single day to get better today than you were yesterday.” "When you know what exactly you want, the world becomes your library." Where Your Attention Goes, Energy Flows - - as long as you put your focus right, you can devote your full attention to the necessary actions required to achieve the desirable results. The more focused your ability is, the faster you will succeed!

Throughout the past years, Altruist has been focusing on enriching our product platform by introducing products ranging from life/medical/accident/critical illness insurance, general insurance, long-medium-and-short-term savings investment, funds, employee benefits, MPF, credit cards, mortgages, overseas properties, immigration services to health solutions. Simultaneously, our financial consultants also focus everyday on performing fact-finding, analysis, preparing proposals, conducting regular reviews and providing after-sales services to assist customers in managing their financial plans.

While 2024 is just around the corner, we remain committed to fulfilling our promises and focusing on working for other people’s welfare and happiness in order to be qualified as a trust-worthy partner to our customers!

Or have you ever met a cleaning lady who works attentively, meticulously and always wear a smiling face?

Obviously, they have exemplified a dedicated work ethic and striven to be the best in their respective professional fields.

As what our President always says, among all industries, only the top 20% of practitioners are of respectable quality; conversely, the bottom 20% are unqualified and fall below standard quality while the middle 60% are mediocre individuals who merely seek for a stable job. Wanna be a part of the top 20%? Perhaps the sharing from the late basketball player Kobe Bryant can offer you an insight about his key to success: "It’s all about focus. Having a focus and purpose in mind, you will find yourself wake up every single day to get better today than you were yesterday.” "When you know what exactly you want, the world becomes your library." Where Your Attention Goes, Energy Flows - - as long as you put your focus right, you can devote your full attention to the necessary actions required to achieve the desirable results. The more focused your ability is, the faster you will succeed!

Throughout the past years, Altruist has been focusing on enriching our product platform by introducing products ranging from life/medical/accident/critical illness insurance, general insurance, long-medium-and-short-term savings investment, funds, employee benefits, MPF, credit cards, mortgages, overseas properties, immigration services to health solutions. Simultaneously, our financial consultants also focus everyday on performing fact-finding, analysis, preparing proposals, conducting regular reviews and providing after-sales services to assist customers in managing their financial plans.

While 2024 is just around the corner, we remain committed to fulfilling our promises and focusing on working for other people’s welfare and happiness in order to be qualified as a trust-worthy partner to our customers!

Altruist Honor (Congrats!)

The Caring Company Scheme Recognition Ceremony (Feb 15)

After 3 years of pandemic attack, we finally had the opportunity to attend “The Caring Company Scheme Recognition Ceremony” this year. Among the 4,352 organizations, Altruist is thrilled to be one of the 89 which has been awarded for Caring Company Logo for 20+ consecutive years. We are grateful for the ardent support from our colleagues as we jointly fulfill our corporate responsibility commitment.

|

|

“Quality Service Recognition” (QSR)

We were grateful to have the honorable presence of Mr. Kenny Siu (Regional Director, Hong Kong & Asia Pacific) from The Chartered Insurance Institute to present the QSR certificates to our financial consultants who have excelled themselves in both production and persistency rate. Congratulations!!

|

|

|

Million Dollar Round Table Membership (MDRT)

With their enduring outstanding performance, Judith Lui and Anita Fan have once again obtained the TOT and COT membership respectively. Congratulations! Additionally, 11 other colleagues have been awarded the prestigious MDRT membership which recognizes their exceptional achievements in professional knowledge, remarkable customer service and performance, adherence to ethical standards and commitment to self-development.

|

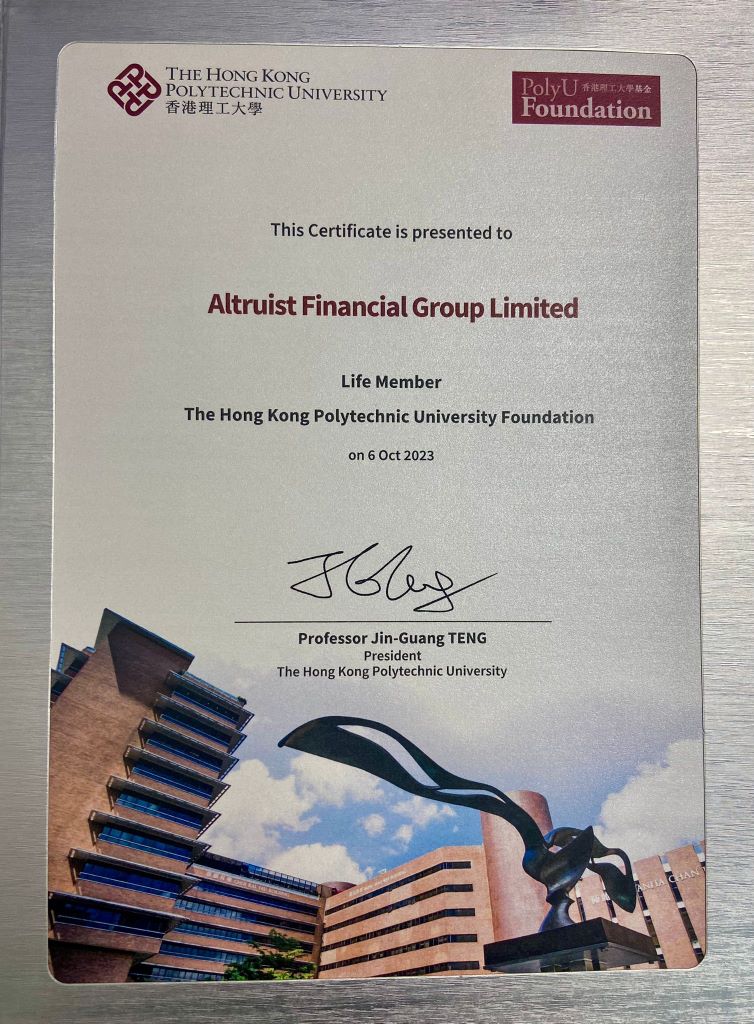

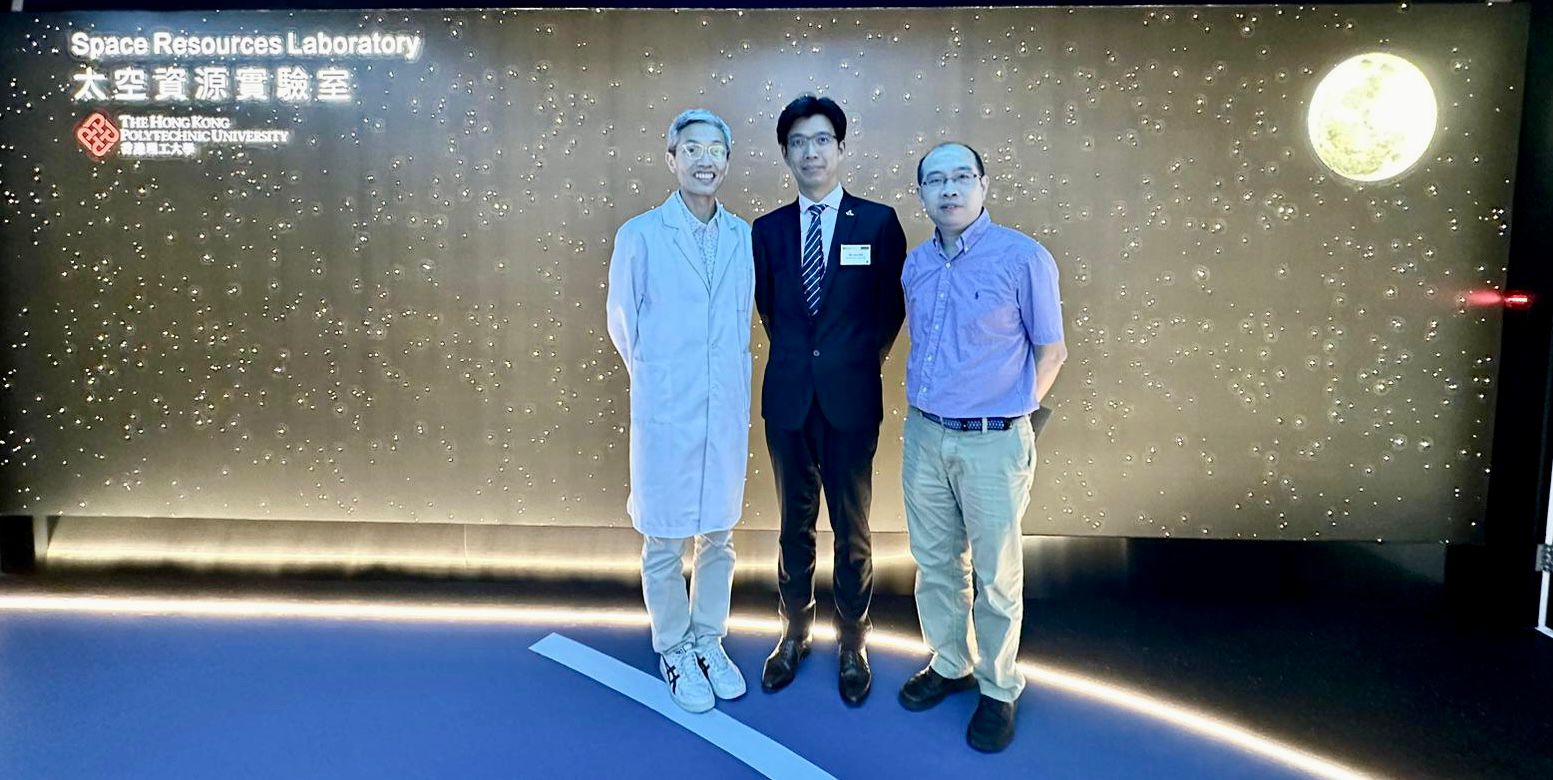

Life Membership of HK PolyU Foundation (Oct 6)

Altruist is now recognized as "Life Member" by the HK PolyU Foundation for our unrelenting support towards the University's development over the past 10+ years. We were delighted to attend the Appreciation Reception and had the privilege to visit the "Research Centre for Deep Space Explorations - Space Resources Laboratory", which plays a vital role in the Moon and Mars exploration projects.

|

|

|

30+ Longstanding Partnership Award as presented by Cigna HK (Sep 21)

Time flies! Cigna HK life agency operations was first established by our President Albert Lam early in 1987 and we continue to go through this amazing journey since the establishment of Altruist in 2001. While Cigna was celebrating its 90th anniversary in HK this year, Altruist was presented the unique and prestigious “30+ Longstanding Partnership Award", demonstrating our unwavering commitment to serving our customers with utmost integrity and professionalism.

|

|

|

What’s New

Annual Awards Presentation Dinner

The Annual Awards Presentation Dinner was successfully held on March 31 at HK Parkview. Among the numerous awards presented, we were indeed very honored to have two special guests to share their collaboration experience with our Top 2 consultants and to present the unique 3D portraits to the winners. A special supplement was published on the same day to recognize their hard-work and dedication. Look forward to another breakthrough year and hope to see you in 2024!

|

|

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|

Recruitment Activities

Our Training Manager Alex Choi and PAP managers (Jenny Cheung and Ronny Sat) have shared with IVDC trainees the prospects of the financial planning industry and the promising career development opportunities.

Date Location

Mar 24 Ma On Shan Centre

Jun 14 Ma On Shan Centre

Date Location

Mar 24 Ma On Shan Centre

Jun 14 Ma On Shan Centre

|

|

|

Appreciation Reception for Scholarship and Bursary Donors 2022/23 (Apr 14)

We were once again invited to attend the Appreciation Reception as organized by HK PolyU. Taking this valuable opportunity, we were able to meet the students in person and have free-flowing conversation.

|

|

|

Occupational Health tips (Apr 28)

In consideration of the physical health of our colleagues, our HR Department has invited representatives from the Labor Department to deliver online occupational health tips to us. Don’t forget to take breaks for exercise or simple stretching during the busy working hours!!

|

|

Sharing Section on Investment Opportunity in Malaysia (Oct 17)

We were delighted to have special guests from Malaysia who came to give us an update on the newly furnished property D'Rapport Residence as well as the latest residence pass options in Malaysia.

Wanna check out more details? Please contact your professional financial consultant or call us on 2297 8000 for assistance!!

Wanna check out more details? Please contact your professional financial consultant or call us on 2297 8000 for assistance!!

|  |

|  |

Company Sponsorship Events

Sponsorship to LUA

LUA 50th Anniversary Kick-off Ceremony (Apr 20)

|

2023 MTA Convention Day (Jul 31)

Our colleague Dicky Cheung was invited as one of the guest speakers to share the theme of “Business Opportunity in a High-Interest Environment”.

|

|

|

|

LUA 50th Anniversary Banquet (Aug 1)

|

|

|

Sponsorship to CII

CII Dive In (Sep 27)

|

|

Professional Elites and Industry Recognitions

FC of the Month

Top Premium Producer

NOV 2022 | JUL 2023 Elsa Chan |  DEC 2022 Anita Fan |  JAN | FEB | MAR | APR | MAY | JUN | AUG | SEP | OCT | NOV 2023 Judith Lui |

Top Case Producer

NOV 2022 & JAN | FEB | MAR | APR | JUN 2023 Judith Lui |  DEC 2022 Dicky Cheung |  MAY | JUL | NOV 2023 Elsa Chan |  AUG 2023 Tommy Ho |

SEP 2023 Ronny Sat |  OCT 2023 Emily Law |

A Club Activities Snapshot

A Club

“Work Hard‧Play Hard”is our culture

The establishment of A Club is to bring work-life balance to colleagues and their family members by organizing various social and charity activities.

The establishment of A Club is to bring work-life balance to colleagues and their family members by organizing various social and charity activities.

A Club Annual Party (Jan 6)

All you can eat-and-drink coupled with exciting games and fabulous lucky draw, everyone has spent an enjoyable and crazy night!

| |

|  |

A Club Spring Dinner (Feb 19)

The exciting riddles, Bingo, crazy games and lucky draw were finally back to the Spring Dinner after 3 years of suspension due to pandemic. Yeah Yeah Yeah!!

|  |

|  |

Support WWF’s Flag Day

Together, let’s raise funds to revive our corals and protect our precious coasts.

|  |

Resistance Band Sharing Activity (Sept 7)

A Club has invited Lawrence Li, the professional coach, to deliver a sharing section on the use of resistance band which can help alleviate muscle pain. Better health, better productivity!!

|  |

|

Caritas HK Voluntary Day (Sept 18)

Partnering with Playright’s Play and Playwork hub, the kids were engaged in tailor-making their own unique yet interesting playing space and toys. We were all impressed by their incredible creativity and team-work.

|  |

|  |

A Club Outing (Nov 4)

The day tour to Sha Tau Kok countryside, walled villages, farmhouses and ancient temple has given us a valuable opportunity to feel the unique and chill countryside vibe.

|  |

|  |

|  |

Market Outlook

A sound financial plan with disciplined execution would be the key of investment success

|

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” This is one of the most famous quotes from Benjamin Graham, the mentor of Warren Buffett and who is also considered as “father of value investing”.

While these few sentences may appear to be very simple, however, it is difficult to put into practice. The investment markets are always filled with different information and investment opinions from different “experts”. Those “noises” often influence investors’ emotions and beliefs. For example, the contentious U.S.-China relationship, ongoing conflicts between Russia-Ukraine and Israel-Palestine and the uncertainty surrounding the Federal Reserve’s decision on interest rate hikes. These factors have brought market volatility and affect investors to make rational investment decisions.

Before formulating a financial or investment plan, it is important to understand that none of us have a crystal ball, and it is impossible to make accurate predictions of the future. However, we may still be able to "follow the macro trend” and make relevant investments. Currently, the market is full of uncertainties, but as inflation remains high, the high interest rate environment will likely continue in the near future. Some short-term bonds with good credit ratings can still provide good yields with low risk. For example, 1- to 2-year U.S. Treasury bonds with current yields ranging from 5-5.4%. Given the extremely low risk of U.S. Treasury bonds, it is believed they can offer relatively stable and fixed returns.

Of course, many investors are not satisfied with only investing in short-term bonds for stable but not very attractive returns. In fact, in addition to short-term item, a comprehensive financial or investment plan should also include investment options with long-term growth, such as equities in the information technology, healthcare science, renewable energy applications sectors.

Those investment options are often related to some irreversible macro trends with high-quality investment value. However, since they are the investment darlings of most of the investors, their valuations are sometimes pushed to levels that are far from reasonable, resulting in higher price volatility. Take the Nasdaq Composite Index, which is dominated by technology stocks, as an example - although it has risen by more than 22% from the beginning of this year to the end of October, it is still nearly 20% below its peak in November 2021. For those asset classes with long-term investment value with high volatility, the best investment method is believed to be dollar-cost averaging, by investing at regular intervals with discipline to average out the overall investment cost and reduce the risk of entering the market at high levels.

A lumpsum investment in short-term, high credit quality bonds may be considered as the core investment portfolio to earn stable and fixed income. In addition, a regular investment in those asset classes with long-term growth potential can be combined as a satellite investment. It is believed that such investment plan may provide good defense as well as good growth potential in the future which readers may consider in the current investment cycle.

Disclaimer

The information contained is for general information only, without warranty of any kind. The information contained should not be regarded as an offer to sell, to subscription, or to provide any investment recommendation. Investment involves risks, past performance is not indicative of future performance. Readers should consult their professional financial consultant before making any investment decision.

Investment Services Department

While these few sentences may appear to be very simple, however, it is difficult to put into practice. The investment markets are always filled with different information and investment opinions from different “experts”. Those “noises” often influence investors’ emotions and beliefs. For example, the contentious U.S.-China relationship, ongoing conflicts between Russia-Ukraine and Israel-Palestine and the uncertainty surrounding the Federal Reserve’s decision on interest rate hikes. These factors have brought market volatility and affect investors to make rational investment decisions.

Before formulating a financial or investment plan, it is important to understand that none of us have a crystal ball, and it is impossible to make accurate predictions of the future. However, we may still be able to "follow the macro trend” and make relevant investments. Currently, the market is full of uncertainties, but as inflation remains high, the high interest rate environment will likely continue in the near future. Some short-term bonds with good credit ratings can still provide good yields with low risk. For example, 1- to 2-year U.S. Treasury bonds with current yields ranging from 5-5.4%. Given the extremely low risk of U.S. Treasury bonds, it is believed they can offer relatively stable and fixed returns.

Of course, many investors are not satisfied with only investing in short-term bonds for stable but not very attractive returns. In fact, in addition to short-term item, a comprehensive financial or investment plan should also include investment options with long-term growth, such as equities in the information technology, healthcare science, renewable energy applications sectors.

Those investment options are often related to some irreversible macro trends with high-quality investment value. However, since they are the investment darlings of most of the investors, their valuations are sometimes pushed to levels that are far from reasonable, resulting in higher price volatility. Take the Nasdaq Composite Index, which is dominated by technology stocks, as an example - although it has risen by more than 22% from the beginning of this year to the end of October, it is still nearly 20% below its peak in November 2021. For those asset classes with long-term investment value with high volatility, the best investment method is believed to be dollar-cost averaging, by investing at regular intervals with discipline to average out the overall investment cost and reduce the risk of entering the market at high levels.

A lumpsum investment in short-term, high credit quality bonds may be considered as the core investment portfolio to earn stable and fixed income. In addition, a regular investment in those asset classes with long-term growth potential can be combined as a satellite investment. It is believed that such investment plan may provide good defense as well as good growth potential in the future which readers may consider in the current investment cycle.

Disclaimer

The information contained is for general information only, without warranty of any kind. The information contained should not be regarded as an offer to sell, to subscription, or to provide any investment recommendation. Investment involves risks, past performance is not indicative of future performance. Readers should consult their professional financial consultant before making any investment decision.

Investment Services Department

Special Feature

“Insurance Tips under Extreme Weather Condition”

“Caution! Bugs!”

In addition to the surprisingly large quantity of snow bugs discovered in Hokkaido in Oct, another wave of bed bugs attack has also been spreading to Seoul recently. These abnormal phenomena might possibly be connected to global climate change. In fact, Hong Kong could not escape from the adverse effect of the climate change neither. In the third quarter of this year, we experienced unprecedented rainstorms, resulting in severe flooding, landslides, tree collapses, broken glass windows, broken down of cars etc. For people who do not have insurance coverage, the losses can be devastating. But what about those who have insurance coverage? Let's explore the different kinds of insurance coverages under bad weather conditions.

Employees' Compensation Insurance

According to the Employees' Compensation Ordinance, if employees suffer from an accident or death (during typhoons or black rainstorms) within 4 hours before or after working hours while traveling directly between their residence and workplace, it is considered to have occurred during the course of employment. In such cases, the employer is responsible for providing compensation as specified in the ordinance, and Employees' Compensation Insurance is applicable then.

Travel Insurance

For travelers whose trip is delayed due to bad weather, the insured person can possibly receive cash allowances, additional reasonable accommodation expenses, non-refundable deposits or fees, and additional expenses incurred due to itinerary changes (subject to the respective policy terms and conditions). Furthermore, if the insured person is required to cancel or cut short the trip due to a natural disaster at the travel destination, relevant coverage is also provided. However, it should bear in mind that Travel Insurance coverage does not apply if Hong Kong, rather than the travel destination, hoisted typhoon/black rainstorm warnings.

Motor Insurance

Hong Kong has recorded record-breaking hourly rainfall during the last attack of black rainstorm, resulting in numerous cars stalling or being submerged in flooded roads and parking lots. If car owners have purchased Comprehensive Motor Insurance and can demonstrate that they have made reasonable efforts to avoid and minimize losses or damages and have maintained their insured vehicles in good condition, they are likely to be compensated by the insurance company. The amount of compensation will be based on the actual repair costs for the vehicle. However, if the insurance company finds that the car owner intentionally puts the vehicle in a dangerous situation, they may reject the claim then.

Due to the higher premiums associated with Comprehensive Motor Insurance, many owners of second-hand cars will tend to buy Third-Party Liability Insurance. However, this kind of insurance only compensates for claims involving injury or death to third parties and does not cover losses or damages to the insured vehicle or property caused by natural or weather-related disasters. Therefore, if a car owner experiences vehicle damage due to flooding and has only purchased Third-Party Liability Insurance, the owner will be fully responsible for the related expenses. Nevertheless, if it can be proven that the incident was caused by negligence of the parking lot or property management company, the car owner may consider pursuing a civil claim for compensation.

Home Insurance

Following the numerous heavy rain storms, the number of Home Insurance policy has gradually increased. Since the terms and conditions, coverages, and limits of policies vary among insurance companies, customers need to pay attention to the specific provisions. Generally, Home Insurance covers losses to insured properties or third-party liabilities, such as damage to household appliances or renovation costs caused by water leaks or windstorms. However, damages to building structures such as walls, floors, ceilings, windows fall under the structural coverage of "Fire Insurance". It is worth noting that in the case of broken glass windows, the coverage depends on whether the windows are original or have been altered by the policyholder. The former falls under structural coverage while the latter falls under the coverage for household properties. If household properties are damaged due to wind and rain disasters, customers should take measures to mitigate the losses in a feasible and safe manner, retain the damaged items, and take photographs as evidence for future claims. As a friendly reminder, when renting out a property as a landlord, please don’t forget to switch the existing Home Insurance to Landlord Insurance. As a tenant, it’s also highly recommended to purchase Home Insurance to protect your own properties.

There’s an incident worth sharing as related to the recent attack of black rainstorms - - a colleague received a call from a client early in the morning on September 8th, informing him of severe flooding in the house and there’s an urgent need to relocate to a hotel. The client was so eager to understand the coverage of his Home Insurance Policy that the colleague immediately contacted the General Insurance Department to follow up. Very promptly, the insurance company has also arranged surveyors for site-visit for inspection and assessment and very shortly has settled the claims then.

In fact, during and after rainstorm strikes, our financial consultants, staff from both General Insurance Departments and insurance companies will get themselves ready early to respond and assist clients in emergency situations. Therefore, while it is important to have an insurance coverage in advance, it is equally important to find a responsible and dedicated financial consultant who can provide prompt assistance when needed.

Source: Sing Tao Daily, Ta Kung Pao, Oriental Daily, HKET

In addition to the surprisingly large quantity of snow bugs discovered in Hokkaido in Oct, another wave of bed bugs attack has also been spreading to Seoul recently. These abnormal phenomena might possibly be connected to global climate change. In fact, Hong Kong could not escape from the adverse effect of the climate change neither. In the third quarter of this year, we experienced unprecedented rainstorms, resulting in severe flooding, landslides, tree collapses, broken glass windows, broken down of cars etc. For people who do not have insurance coverage, the losses can be devastating. But what about those who have insurance coverage? Let's explore the different kinds of insurance coverages under bad weather conditions.

Employees' Compensation Insurance

According to the Employees' Compensation Ordinance, if employees suffer from an accident or death (during typhoons or black rainstorms) within 4 hours before or after working hours while traveling directly between their residence and workplace, it is considered to have occurred during the course of employment. In such cases, the employer is responsible for providing compensation as specified in the ordinance, and Employees' Compensation Insurance is applicable then.

Travel Insurance

For travelers whose trip is delayed due to bad weather, the insured person can possibly receive cash allowances, additional reasonable accommodation expenses, non-refundable deposits or fees, and additional expenses incurred due to itinerary changes (subject to the respective policy terms and conditions). Furthermore, if the insured person is required to cancel or cut short the trip due to a natural disaster at the travel destination, relevant coverage is also provided. However, it should bear in mind that Travel Insurance coverage does not apply if Hong Kong, rather than the travel destination, hoisted typhoon/black rainstorm warnings.

Motor Insurance

Hong Kong has recorded record-breaking hourly rainfall during the last attack of black rainstorm, resulting in numerous cars stalling or being submerged in flooded roads and parking lots. If car owners have purchased Comprehensive Motor Insurance and can demonstrate that they have made reasonable efforts to avoid and minimize losses or damages and have maintained their insured vehicles in good condition, they are likely to be compensated by the insurance company. The amount of compensation will be based on the actual repair costs for the vehicle. However, if the insurance company finds that the car owner intentionally puts the vehicle in a dangerous situation, they may reject the claim then.

Due to the higher premiums associated with Comprehensive Motor Insurance, many owners of second-hand cars will tend to buy Third-Party Liability Insurance. However, this kind of insurance only compensates for claims involving injury or death to third parties and does not cover losses or damages to the insured vehicle or property caused by natural or weather-related disasters. Therefore, if a car owner experiences vehicle damage due to flooding and has only purchased Third-Party Liability Insurance, the owner will be fully responsible for the related expenses. Nevertheless, if it can be proven that the incident was caused by negligence of the parking lot or property management company, the car owner may consider pursuing a civil claim for compensation.

Home Insurance

Following the numerous heavy rain storms, the number of Home Insurance policy has gradually increased. Since the terms and conditions, coverages, and limits of policies vary among insurance companies, customers need to pay attention to the specific provisions. Generally, Home Insurance covers losses to insured properties or third-party liabilities, such as damage to household appliances or renovation costs caused by water leaks or windstorms. However, damages to building structures such as walls, floors, ceilings, windows fall under the structural coverage of "Fire Insurance". It is worth noting that in the case of broken glass windows, the coverage depends on whether the windows are original or have been altered by the policyholder. The former falls under structural coverage while the latter falls under the coverage for household properties. If household properties are damaged due to wind and rain disasters, customers should take measures to mitigate the losses in a feasible and safe manner, retain the damaged items, and take photographs as evidence for future claims. As a friendly reminder, when renting out a property as a landlord, please don’t forget to switch the existing Home Insurance to Landlord Insurance. As a tenant, it’s also highly recommended to purchase Home Insurance to protect your own properties.

There’s an incident worth sharing as related to the recent attack of black rainstorms - - a colleague received a call from a client early in the morning on September 8th, informing him of severe flooding in the house and there’s an urgent need to relocate to a hotel. The client was so eager to understand the coverage of his Home Insurance Policy that the colleague immediately contacted the General Insurance Department to follow up. Very promptly, the insurance company has also arranged surveyors for site-visit for inspection and assessment and very shortly has settled the claims then.

In fact, during and after rainstorm strikes, our financial consultants, staff from both General Insurance Departments and insurance companies will get themselves ready early to respond and assist clients in emergency situations. Therefore, while it is important to have an insurance coverage in advance, it is equally important to find a responsible and dedicated financial consultant who can provide prompt assistance when needed.

Source: Sing Tao Daily, Ta Kung Pao, Oriental Daily, HKET

Copyright © 2024 Altruist Financial Group Limited.All rights reserved.